Sun Life Financial

United States Choose a locationLooking for information about Sun Life and our affiliated companies in your area? Select your country below to travel to a website for information specific to your region.

- Worldwide

- www.sunlife.com

- Bermuda

- www.sunlife.com/bermuda

- Canada

- www.sunlife.ca www.mcleanbudden.com www.sunlifeglobalinvestments.com

- China

- www.sunlife-everbright.com

- Hong Kong

- www.sunlife.com.hk

- India

- www.birlasunlife.com www.sunlife.com/asiaservicecentre

- Indonesia

- www.sunlife.co.id www.cimbsunlife.co.id

- Ireland

- www.sunlife.ie

- Philippines

- www.sunlife.com.ph www.sunlifegrepa.com www.sunlife.com/asiaservicecentre

- United Kingdom

- www.sloc.co.uk

- United States

- www.sunlife.com/us www.mfs.com

- Home |

- Get to know us |

- Site map |

- Talk to us

Variable annuities

Effective December 30, 2011, this product and/or living benefit rider will no longer be available for sale

Sun Income MaximizerSM Plus

Sun Income Maximizer Plus gives you the opportunity to accumulate your retirement income so you can enjoy the lifestyle that’s important to you. Better yet, it also helps maximize your income for lifelong protection. A living benefit like Sun Income Maximizer Plus,1 available with our Sun Life Financial Masters® variable annuities for an additional cost,2 can help regardless of what happens in the market.

Sun Income Maximizer Plus provides these three key benefits: |

|||||

|

Money managers | |

|

Guarantees | |

|

Maximize for life |

|

| 1. Premier money managers |

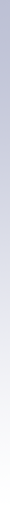

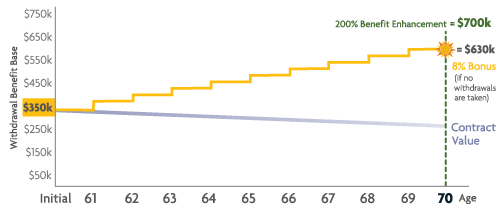

| We've selected a variety of money managers and funds to give your income the opportunity to grow with strong market performance. See below for how Sun Income Maximizer Plus performs in an up market. Growth potential in an up market In a rising market, your Withdrawal Benefit Base can increase with market gains (if any) reflected in your contract value – this is called a step-up. |

|

| View the hypothetical illustrative values.

On each Contract Anniversary, we automatically compare the contract value to the Withdrawal Benefit Base (increased for step-ups or bonuses, if any). The higher amount becomes the new Withdrawal Benefit Base. In the hypothetical illustration above,3 we are showing that a step-up occurs at ages 63 and 67. The 8% Bonus is calculated on a higher Withdrawal Benefit Base as a result of the step-up. At age 70, your new Withdrawal Benefit Base is equal to the growth from the combination of the step-up and 8% Bonus, and it is greater than the 200% Benefit Enhancement. By growing the Withdrawal Benefit Base, you can potentially get more future income. |

| Back to top |

|

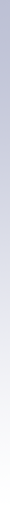

| 2. Accumulate your benefit with Sun Life's guarantees |

Even if the contract value of your annuity is down from market losses, your retirement income is protected and has the opportunity to grow with these two important guarantees.

During the first 10 contract years, you can earn an 8% Bonus on the amount we use to calculate your lifetime income (this is called your Withdrawal Benefit Base) for each year prior to taking withdrawals. The Withdrawal Benefit base cannot be withdrawn as a lump sum or in cash.

Your Withdrawal Benefit Base can increase to equal at least 200% of your first-year purchase payments at age 70 (or 10 years from the issue date if later) if you wait to take your lifetime income. Guaranteed growth in a down market Sun Income Maximizer Plus’s built-in guarantees provide growth potential even if your contract value falls due to market losses with the 8% Bonus or 200% Benefit Enhancement, whichever is greater. |

|

| View the 1B hypothetical illustrative values.

In the hypothetical chart above,4 at age 70 your initial Withdrawal Benefit Base of $350,000 will be increased to the higher of the following amounts:

The Withdrawal Benefit Base at age 70 (after Bonuses) is $630,000. The 200% Benefit Enhancement is twice the initial Base of $350,000, or $700,000 (assuming no purchase payments were made after the first year). Therefore, the Withdrawal Benefit Base would be increased to $700,000. |

| Back to top |

|

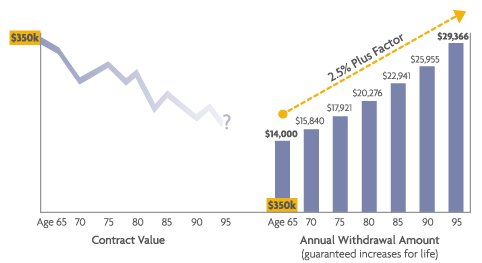

| 3. Help keep pace with rising costs |

|

The Plus Factor Sun Income Maximizer Plus also includes the “Plus Factor” to help your income keep pace with rising costs. Once you begin taking lifetime income, the Plus Factor increases your Withdrawal Benefit Base (and your lifetime income) by 2.5% (compounding interest) every year. |

View the hypothetical illustrative values. The hypothetical chart above5 assumes you have $350,000, but market losses cause the value to fall to below your initial investment (and it may decline even more). However, in this example, as a result of the Plus Factor being applied to the Withdrawal Benefit Base, the lifetime income goes up every year even though the contract value is falling. While you start with an annual income of $14,000, by age 95 you have an annual income of $29,366. |

| Back to top |

Living benefits

Sun Income Riser III – guaranteed growth of your benefit base for your future income

Sun Income Maximizer – flexible options to help maximize your future income in any market

Sun Income Maximizer Plus – innovative feature to help your income keep pace with rising costs

Investment options

Gain access to some of the top money managers and funds